Latin America and the Caribbean count almost 640 million inhabitants and a per capita GNP of about USD 9,000.

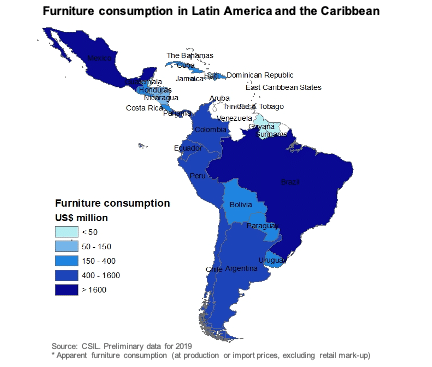

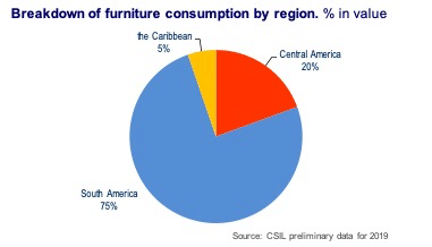

According to CSIL estimate, the furniture market of this region is worth about 16 USD billion at production/import prices.

This year CSIL has further explored the furniture sector for a selection of Latin American countries: Argentina, Ecuador and Uruguay in South America, and Panama and Costa Rica in Central America. Some findings are reported in this article.

The Argentina furniture industry counts over 2,000 registered companies, 90% of which are SMEs. A significant share of the furniture sector is constituted by “grey production” of informal producers who may account to up to even 40%-50% out of the total one. Leading players in the industry include companies as Fontenla, Ricchezze (home furniture segment), Fiplasto, Cuyoplacas/ Platinum (RTA), Johnson Acero, Amoblamientos Reno (kitchen furniture), Color Living (upholstered furniture). In the last couple of years, the country’s industry has been experiencing a period of crisis, mainly due to the decline of its internal market, as well as the erosion of profitability determined by high interest rates and the higher costs of dollarized components. On the other hand, the Argentinian industry can count on significant structural assets, including for example its large endowment of forestry resources, the existence of production clusters, the presence of dynamic sector associations. Imported furniture is estimated to account for around 20% out of the total Argentinian market, China accounting for the majority of this.

Over 650 companies are part of the Ecuadorian Forestry and Wood Processing sector, including furniture manufacturers. The local furniture industry can count on the presence of significant local wood-based panel producers who satisfy the majority of the total demand of panels from the industry. Novopan and Aglomerados Cotopaxi are the largest ones. Among the main furniture producers in the industry there is Colineal, which is also a key player in furniture retail. The Ecuadorian producers are mostly focused on the domestic market. After a sharp decrease observed in 2015-2016, the Ecuadorian market seems to have come back to moderate growth in the last few years. The market is relatively less open than the average for the South America and Caribbean region, its import penetration being around 20%. However, imports have been increasing in the last years.

The Uruguayan furniture industry is much fragmented and lacks large producers. Nearly 90% of firms employ less than 4 workers, and only 2% have more than 20 workers. About 40% out of total local production is exported (mainly to Argentina), whereas the domestic market absorbs 60%. Uruguay shows a relevant higher per capita furniture consumption than its neighboring countries. The country’s distribution system is marked by the key role played by importers, which include both furniture shops, and companies operating both as wholesalers and retailers. The share of import out of total furniture consumption has increased over the last decades. In particular, the establishment of Mercosur in 1989 was a turning point for the local market, as it paved the way for an increase in import from the members of this agreement, especially from Brazil.

The Panama furniture industry is formed mainly by small and microenterprises, with a significant presence of the grey sector. The Panamanian industry includes several high-end small companies focused on solid wood, which in general is quite widespread in the local industry. Among the most used type of woods there are cedar, laurel, and teak wood, which traditionally had a significant diffusion due to its peculiar durability in humid environments. Over the last decade the harsh competition from foreign suppliers has been a major challenge faced by the local furniture industry. The large majority of the market is satisfied by import. Several leading distributors belong to foreign chains.

Costa Rica’s furniture sector counts approximately 200 registered companies, mainly by micro and small enterprises. Also in this country many furniture producers are focused to a significant extent on solid wood. Most of the country’s market is satisfied by import. The country’s distribution system includes direct sales of local producers to consumers, stores specialized in furniture (as for example La Artística), and large chains non specialized in furniture, as homeware/household goods stores, home improvement stores, supermarkets.

0 Comments