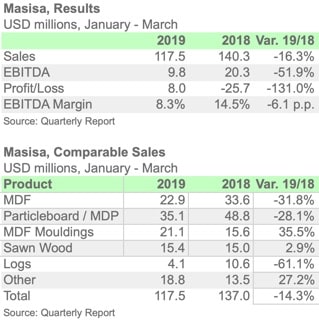

CHILE – Masisa’s consolidated sales revenues in the first quarter of the year (1Q-2019) amounted to USD 117.5 million, which is equivalent to a decrease of 16.3% or USD 22.9 million with respect to the first quarter of 2018 (USD 140.3 million).

In 1Q-2019, consolidated EBITDA reached USD 9.8 million, representing a decrease of USD 10.5 million compared to the same period of the previous year. As with sales, consolidated EBITDA was impacted by a lower contribution from Mexico as a result of the partial sale of assets in this country and by lower forest EBITDA in Chile and Argentina. In addition, Masisa highlighted as an additional factor the negative effect of lower EBITDA in Chile’s industrial commercial business, due to the impact of the commercial conflict between the United States and China.

At present Masisa is turning its efforts to enhance its commercial strategy and maximize its profitability through what have been its most relevant strengths and competitive advantages. The Company is focused on raising the level of innovation, expanding the value-added alternatives in products and services, promoting new integral solutions, and developing sales channels through new technologies with a business model less intensive in industrial capital.

In this context, the company has carried out in recent years a divestment process that included the sale of the industrial assets of Argentina and Brazil and two of the three plants in Mexico, which allowed it to raise funds for close to USD 420 million, which is expected to be complemented with the sale of forest assets announced at the beginning of 2019.

These divestments will allow Masisa to focus its commercial activity on higher value-added businesses in the Andean Region, Central America, the United States, Canada, Asia and other export markets, maintaining its productive capacity to supply the region from Chile.

As a result of the proactive transformation that the company is carrying out, the level of indebtedness has been significantly reduced, which, together with a reduction in corporate and operational expenses, will allow it to significantly improve the profitability of its business. In this regards, since January 1st, 2017, gross financial debt has decreased by USD 209.0 million (excluding the impact of IFRS 16).

0 Comments