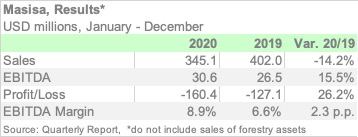

CHILE – Without considering the sale of forestry assets in Chile, Masisa’s sales in 2020 reached USD 345.1, a drop of 14.2 percent compared to 2019. Including forestry assets, the Company closed 2020 with consolidated sales revenues of USD 574.2 million, an increase of 42.8% compared to 2019.

Both indicators registered an increase in the fourth quarter (October-December), confirming the improvement already shown in the previous quarter (July-September), due, in large part, to the implementation of a strategy focused on the efficiency and profitability of the company, centered on the sale of higher value-added products, also to the recovery in demand for construction-related products in the main markets in which the company operates.

According to Alejandro Carrillo, General Manager of Masisa, “we confirmed the change in trend in our results with a significant improvement in the last two quarters, as a result of our new corporate strategy and the recovery of demand in our markets. We see that this trend has been maintained in the first months of 2021, so we are optimistic regarding the next few months.”

Financial debt as of December 2020 stood at USD 148 million, which represented a significant decrease of USD 335 million compared to USD 483 million in June 2020, notably improving the debt and liquidity indicators of the company, and ending a reorganization process carried out in recent years that allowed the company to reduce its debt from levels close to USD 600 million.

It is important to note that although a loss of USD 162 million was recorded in 2020, this is the consequence of non-recurring effects, associated with financial restructuring and accounting effects related to asset impairments associated with the situation of the markets in Venezuela and Argentina.

Currently, the company is strengthening its commercial strategy, maximizing its profitability through products and services with higher added value and developing sales channels through new technologies with a more customer-oriented business model, concentrating its industrial capacity mainly in Chile.

0 Comments