CHILE – Masisa S.A. presented its Consolidated Financial Statements for the first quarter of 2021.

The foregoing as a consequence of the execution of the strategic plan promoted by the Company and the greater demand in the markets for construction products.

Additionally, in the Sawn Timber Solutions an increase in income is observed mainly associated with an increase in the average price, due to the focus on products and markets with higher added value.

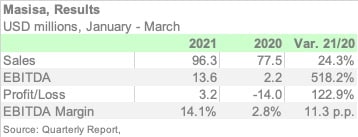

Consolidated EBITDA reached USD 13.6 million, which represents an increase of USD 11.4 million compared to the same period of the previous year, as a consequence of an increase in demand and improvement in margins due to the focus on products with higher added value and cost efficiencies associated with the execution of the strategic plan.

Net financial debt reached USD 116.9 million. It should be noted that with the proceeds from the sale of Chilean forestry assets, the Company successfully concluded its financial restructuring process, completed in the second half of 2020. Gross financial debt decreased from USD 472.8 million in March 2020 to USD152.0 million in March 2021.

During 1Q-2021, Masisa’s investments reached USD 4.6 million, in line with the investment plan. It should be noted that this amount incorporates the effect of imports of spare parts that arrived in 1Q-2021, maintaining the annual plan for 2021 between USD 10 million and USD12 million.

0 Comments