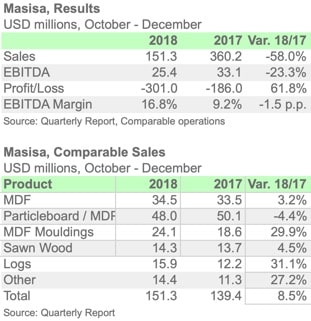

CHILE – Masisa, a Chilean manufacturer of wooden panels with industrial operations in Chile and Mexico, published its results for the fourth quarter of 2018 in which it recognizes the negative effects of the deconsolidation of its operations in Venezuela for USD -284.5 million net of taxes.

In 2018, the financial results without the effects of a single time reached USD 57.9 million, which represents an increase of USD 30.2 million compared to the adjusted result for the year 2017 (without one-time effects) ). With these one-time effects, the result of financial year 2018 reached a loss of USD 220.3 million in the year.

With this divestment process, Masisa is turning its efforts to accelerate its commercial strategy and maximize its profitability through what have been its most relevant strengths and competitive advantages, to raise the level of innovation, expand the alternatives of added value in products and services, promote new integral solutions, and develop sales channels through new technologies with a business model less intensive in industrial capital.

In this context, the company during these last years carried out a divestment process that considered the sale of the industrial assets of Argentina, Brazil and two of the three plants in Mexico, which allowed it to raise funds in excess of USD420 million, which seek to deliver to the company greater financial strength and more flexible capital structure.

On January 31, 2019, the sale of the Durango and Zitacuaro industrial complexes in Mexico was completed in a company value of USD 160 million, maintaining the Chihuahua complex, which is expected to maintain a relevant presence in this market.

More recently, on April 5th, Masisa announced through an material fact release the start of the sale process of its forest assets in Chile and Argentina “with the aim of strengthening and boosting the company’s new commercial strategy, with a focus on the Pacific and in the final client”. The board of Masisa believes that for this new focus, vertical integration is not a determining factor, which is why this process represents an opportunity to maximize the forest assets’ value and to generate tangible value for the company’s shareholders.

0 Comments