POLAND – As reported by ITTO, A close analysis of EU internal trade flows suggests that the Polish wood furniture industry, which is expanding partly at the expense of manufacturing in western European countries, particularly Germany, is playing an important role to drive the on-going rise in internal EU trade.

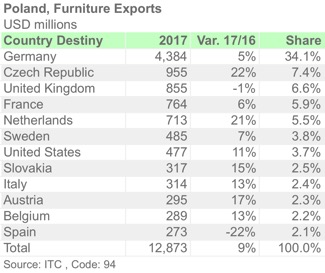

This has been achieved by exploiting the combination of the EU’s common market in goods, proximity to Germany and other large western European markets, and low labor costs. Hourly labor rates average only around €9 in Poland compared to €27 for the EU as a whole and €34 in Germany. Germany is Poland’s largest furniture export market with a share of around 30% of total trade, followed by UK, Czech Republic, France and the Netherlands.

At present, there are over 27,000 Polish companies involved in furniture manufacturing, although only 407 large and medium-sized enterprises account for three quarters of production. Poland is the second largest supplier of furniture to Ikea after China. The Swedish giant operates a dozen factories in the country and is the largest company in the furniture industry in Poland.

Nevertheless, the Polish furniture industry is also characterized by many companies with domestic capital, which are becoming leading players in the Central and Eastern European market. Efforts are also being made by these companies to increase production and sales of own brand product.

0 Comments